Description

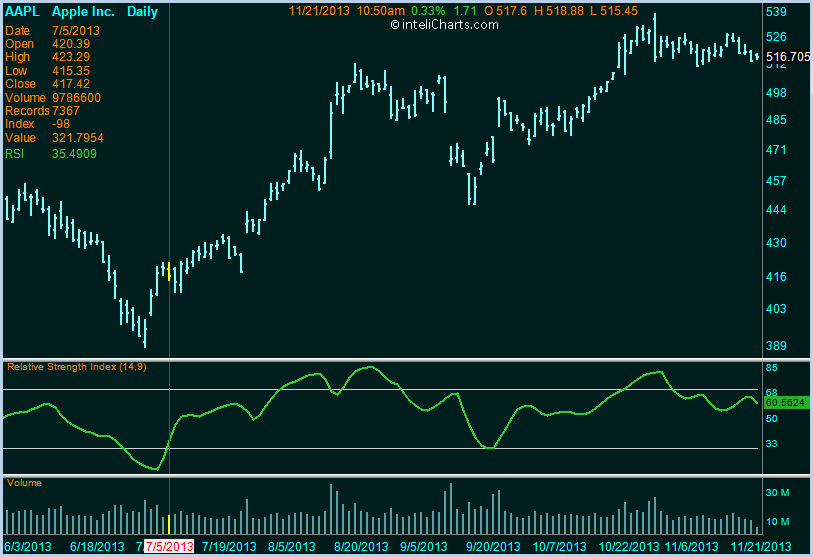

Relative Strength Index is a price momentum indicator that ranges between 0 and 100. It measures the speed of change of prices of the underlying security.

Formula

rsiArray[] = 100-(100/(1+EMA(upArray,2*period-1)/EMA(downArray,2*period-1))) where

upArray[] = close>close[-1] ? close-close[-1] : 0

downArray[] = close[-1]>close ? close[-1]-close : 0

Interpretation

Relative Strength Index above 70 indicates overbought condition, RSI falling below 30 indicates the underlying security may be oversold. RSI may also be used as a trend indicator where rising RSI values indicate a positive trend and falling RSI values indicate a negative trend.

inteliCharts Predictive Analytics - Calculating Most Probable Future Stock Prices

- Neural network architecture

- Quantitative processing

- Long term forecasting

- Intraday probability channels