Description

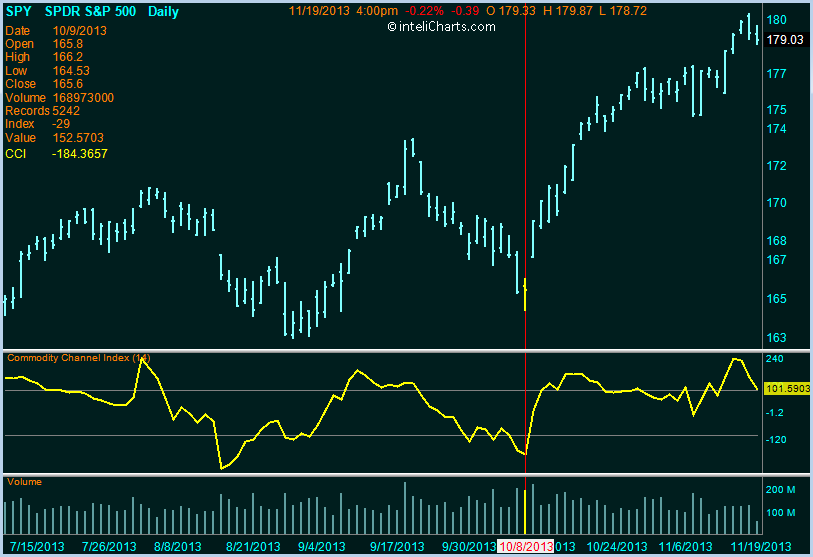

Commodity Channel Index helps identify overbought or oversold conditions of the underlying security by measuring the relationship between security's price and an average price level for the security over a period of time.

Formula

cciArray[] = ((high+low+close)/3-MA)/(0.015*sum((abs(highArray[period]+lowArray[period]+closeArray[period])/3-MA))/period)

where MA = (sum(highArray[period]+lowArray[period]+closeArray[period])/3)/period

Interpretation

Commodity Channel Index indicates overbought condition when CCI moves above 100, oversold condition is indicated when CCI moves below -100.

inteliCharts Predictive Analytics - Calculating Most Probable Future Stock Prices

- Neural network architecture

- Quantitative processing

- Long term forecasting

- Intraday probability channels