Description

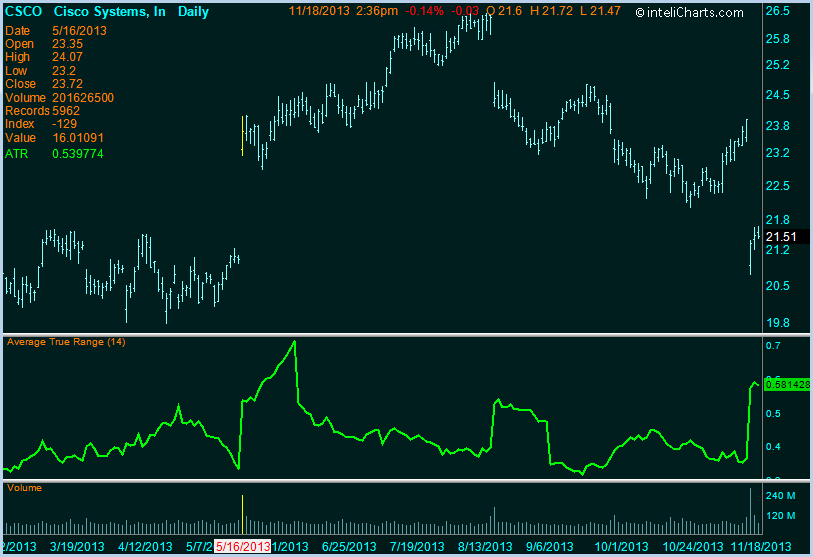

Average True Range indicator provides a measure of price volatility. Originally developed by J. Welles Wilder for use in commodity markets but the ATR indicator works just as well when applied to stocks or indices.

Formula

atrArray[] = Sum(Array[n=0...n=range-1](Max(Abs(Low-Close[-1], Max(High-Low, Abs(High-Close[-1])))))) / range

Interpretation

Average True Range indicator is applied in scenarios where volatility of underlying security needs to be measured.

inteliCharts Predictive Analytics - Calculating Most Probable Future Stock Prices

- Neural network architecture

- Quantitative processing

- Long term forecasting

- Intraday probability channels